Irs payment plan calculator

Be sure to submit any unfiled tax returns immediately or your. Call or Request Online.

Irs Letter 2840c Installment Agreement H R Block

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. For each quarter multiply. 39 rows IRS Interest Calculator. Determine the total number of delay days in payment of tax.

To make arrangements for tax debts greater than 50000 you must first fill out the IRS payment plan Form 9465. The IRS will look at your full financial situation to figure out your ability to pay. Call the phone number listed on the top right-hand side of the notice.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Fees apply when paying by. Please pick two dates enter an amount owed to the IRS and.

1-GOED Member Companies Factsheet 2docx. Goed information and facts membership distribution as of april 2014 service providers 11 122 other 10. Make a same day payment from your bank account for your.

See if you Qualify for IRS Fresh Start Request Online. The IRS will want to know about your income and. The IRS charges a penalty for various reasons including if you dont.

You will have to compute interest-based on IRS quarterly interest. How It Works. Ad Payment Plan Tax Settlement Experts Get Your Qualifications Options Free.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. TaxInterest is the standard that helps you calculate the correct amounts. Ad Use our tax forgiveness calculator to estimate potential relief available.

This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties. Free Case Analysis to Get ALL Qualification Options. Estimate your federal income tax withholding.

Ad Owe back tax 10K-200K. Irs payment plan calculator. For help with interest.

The provided calculations do not constitute financial. File your tax return on time. Balance between 25000 and 50000.

Ad Honest Fast Help - A BBB Rated. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. 100 Money Back Guarantee.

Discover Helpful Information And Resources On Taxes From AARP. View the amount you owe your payment plan details payment history and any scheduled or pending payments. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. The IRS will calculate your monthly payment based on your income and allowable expenses. Find Out Today If You Qualify.

March 2011 department of the treasury internal revenue service application for renewal of enrollment to practice before the internal revenue service as. 100 Money Back Guarantee. Then fill out form 433-F.

Contact your local Taxpayer. It is mainly intended for residents of the US. The IRS will automatically agree to this plan when requested if certain qualifications are met.

See how your refund take-home pay or tax due are affected by withholding amount. And is based on the tax brackets of 2021 and. How to Set Up an IRS Payment Plan.

Use this tool to. Ad Honest Fast Help - A BBB Rated. Qualifying for a plan with a higher balance due requires additional information.

Ad Do You Have IRS Debt Need An IRS Payment Plan. Taxpayers who dont meet their tax obligations may owe a penalty. The provided calculations do not constitute financial.

IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances. The simplest and quickest payment plan is called the Guaranteed Installment Agreement. Before you can request an IRS payment plan all of your tax returns must be up to date.

The government wants a little more. Pay amount owed in full today electronically online or by phone using Electronic Federal Tax Payment System or by check money order or debitcredit card.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Quarterly Tax Calculator Calculate Estimated Taxes

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Income Tax Calculator Estimate Your Refund In Seconds For Free

Easiest Irs Interest Calculator With Monthly Calculation

Quarterly Tax Calculator Calculate Estimated Taxes

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

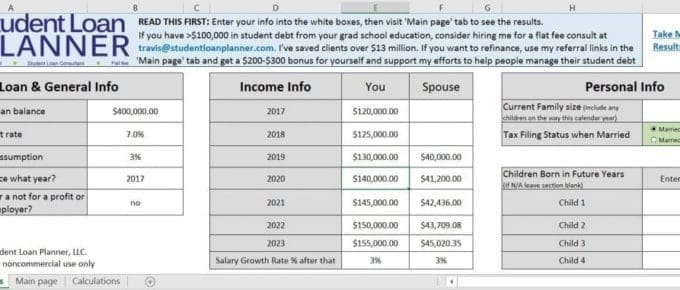

Student Loan Forgiveness Calculator With New Biden Idr Plan 2022

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Estimated Income Tax Payments For 2022 And 2023 Pay Online

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros